- Tribal Finance

- Posts

- The DeFi Frontier October 2nd, 2023

The DeFi Frontier October 2nd, 2023

Welcome back to another exciting edition of DeFi Frontier! We’ve got much to cover, We’ll be breaking down the ETH ETF Futures—what they are and why you should care. 🚀 We're also diving deep into Quantum Computing and its groundbreaking implications for our crypto universe! 🖥️ As well as looking at some Real-World Assets (RWAs) and uncovering the scoop behind the latest ETF delays. Let’s dive right in!

Spotlights 🔍

Quantum Dilemma in Digital Evolution [Link]

Quantum computing looms as a transformative yet disruptive force, posing significant risks to the security foundations of cryptocurrencies and Web3. The race towards quantum-resistant solutions is crucial to preserving trust and integrity in our evolving digital landscape.

What would a Quantum Dilemma entail?

In a hypothetical scenario, Quantum computing possesses the capability to break the sha256 encryption, a fundamental component used by the largest cryptocurrency, Bitcoin. If Quantum computing were readily accessible, the implications would extend far beyond the realm of cryptocurrency. The potential consequences could be significant, with possible breaches in infrastructure and a complete transformation of the internet as we currently understand it into a chaotic and unpredictable state.

Pioneering Ethereum ETF by Valkyrie Investments [Link]

Valkyrie Investments has broken new ground by gaining approval to launch the first ETF featuring Ethereum futures, a significant stride in bringing digital assets to mainstream U.S. finance and enhancing retail crypto engagement.

Significance of Ethereum ETF futures

While it's important to note that this isn't identical to a spot ETF, it does serve to strengthen the position of Ethereum in the market. This recent approval could be seen as a glimmer of hope for the potential future approval of a spot ETF. Such an approval would necessitate investment firms to acquire real Ethereum, further validating its permanence in the financial landscape.

Gensler's Critical Eye on Crypto [LINK]

SEC Chair Gary Gensler continues to express stringent views on cryptocurrency practices, underscoring major concerns over asset management and the urgent need for more comprehensive regulatory frameworks in the evolving digital asset landscape.

Opinion

Gary Gensler's unwavering stance against the crypto industry is becoming less certain amidst recent legal challenges and mounting congressional pressure. During his testimony, his reluctance to provide clear answers on the SEC's stance on spot bitcoin ETFs added to the industry's uncertainty. Ongoing court battles and the broader regulatory landscape further muddy the waters. As Gensler's critique of crypto practices remains steadfast, external pressures are intensifying, leaving the industry eagerly awaiting clarity on how the SEC will navigate these complex issues.

Chase UK’s Proactive Ban on Crypto Purchases [Link]

In response to escalating crypto-related frauds, Chase UK will enforce a ban on cryptocurrency purchases from October 2023. This action underscores the pressing need for strengthened security and regulation in the rapidly evolving intersection of traditional finance and digital assets.

Tweet of the Week 📅

Costco started selling gold bars and they sold out almost immediately.

This raises an important question: When will Costco start selling #Bitcoin?

— Mike Alfred (@mikealfred)

3:18 AM • Sep 30, 2023

Tweet Opinion 💡

Seeing gold bars fly off the shelves at Costco speaks volumes about the appetite for solid commodities in today’s market—it's crystal clear that people are looking for diverse and reliable investment avenues. Given Bitcoin’s status as a recognized commodity, this trend hints at a promising value trajectory and broader acceptance trajectory.

In this evolving financial climate, the convergence of robust demand for commodities, retail accessibility, and decentralized assets like Bitcoin seems to be painting the picture of a future where such digital assets are not just commonplace but are reshaping consumer investment preferences and financial strategies at a foundational level. When Bitcoin in Costco?

The Learning Den 📚

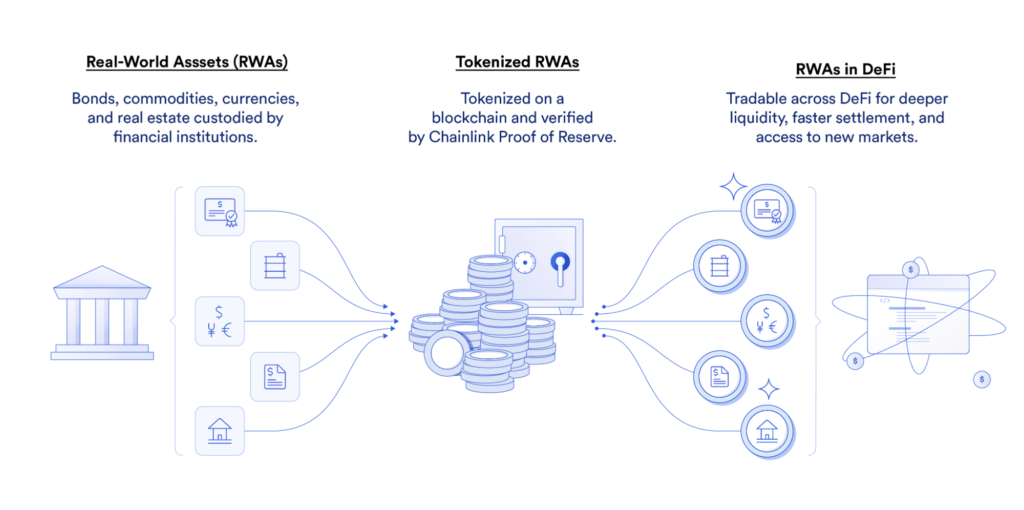

Are you interested in learning about RWA protocols? This week in the learning Den, we’ve included some content that can potentially further help your understanding. Check it out!

Here is a well-put-together video that describes RWA

📌 Below is a lengthy Intro to RWA article.